The Pulp and Paper Industry's Path to Sustainability and Growth

The question of whether to categorize a facility as a pulp mill or a biorefinery might not be the most pertinent. In reality, a pulp mill functions as a biorefinery. The crucial inquiry is whether an industry known for its adherence to traditional methods, risk aversion, and focus on commodity production can adapt to become more innovative, agile, and responsive to evolving market dynamics. Is the leadership within the industry prepared for transformative change, and do they acknowledge the necessity for it?

Historical evidence presents a mixed response to these questions. Instances of rapid changes in industries have typically prompted swift adaptations. For instance,decades before I became a pulp and paper executive, I was an investment banker, leading strategy and M&A transactions for technology and communication companies. I witnessed firsthand the hyper growth of the mobile phone industry. In 1990, there were 11 million mobile phone users. By 2020, there were over 2.5 billion users worldwide.

The legacy wireline phone companies had no choice but to adapt and transform. Conversely, slow industry change often gets little to no industry response. The pulp and paper industry, and more specifically products such as uncoated free sheet, coated free sheet, and newsprint, have experienced significant demand decline for many years, mainly due to the internet. This decline has been met with little to no response, an unwillingness to make investments, machine closures, or worse yet, mill closures.

Navigating Market Shifts

Examining which companies or sectors successfully navigated declining markets and which failed can provide valuable insights. For instance, Blockbuster, once a dominant force in the video rental industry, failed to foresee the potential of emerging technologies like Netflix. At its peak, they had 9,000 stores and a value of US $5.0 billion. In the early 2000s they had numerous chances to buy a new startup company, Netflix, for $50 million. Blockbuster executives explained why they didn't pursue Netflix.

They said they were concerned Netflix was not profitable and would erode their current business. Similarly, Kodak overlooked the potential of digital photography, fearing it would undermine their existing film business. Both companies viewed innovation as risky and opted for a perceived “no-risk” approach, ultimately to their detriment. Blockbuster was eventually sold at a fraction of its peak value, Kodak filed for bankruptcy in 2012. Today, Netflix has an enterprise value of over US $250 billion.

The search for sustainable solutions

Over the last several decades, our understanding of how civilization impacts the environment has evolved. The human population has increased exponentially, and the world is becoming more modern. We are adding 1 billion people every 10 to 12 years. This growth has created a need for reliable energy, clean water, food, and sustainable materials. As civilization continues to mature, these needs will only increase. Every year, over 100 million people globally enter the middle class. The combination of population growth along with the modernization of civilization has created increasing demands on these resources, quickly becoming unsustainable. As a result, governments and businesses alike are looking for solutions.

What industry is in a better position than pulp and paper to meet this growing demand? Can we process renewable biomass and use technology to replace oil and energy? Do we have access to the wood supply? Can we transform wood into a sustainable source of fuels and renewable materials needed for modern day life? If so, is the technology commercially available, do we have the engineering and technical expertise to execute, can we leverage an existing supply chain, and can it be done profitability?

How can the pulp and paper industry help?

Let’s have a closer look at the role the pulp & paper industry could play.

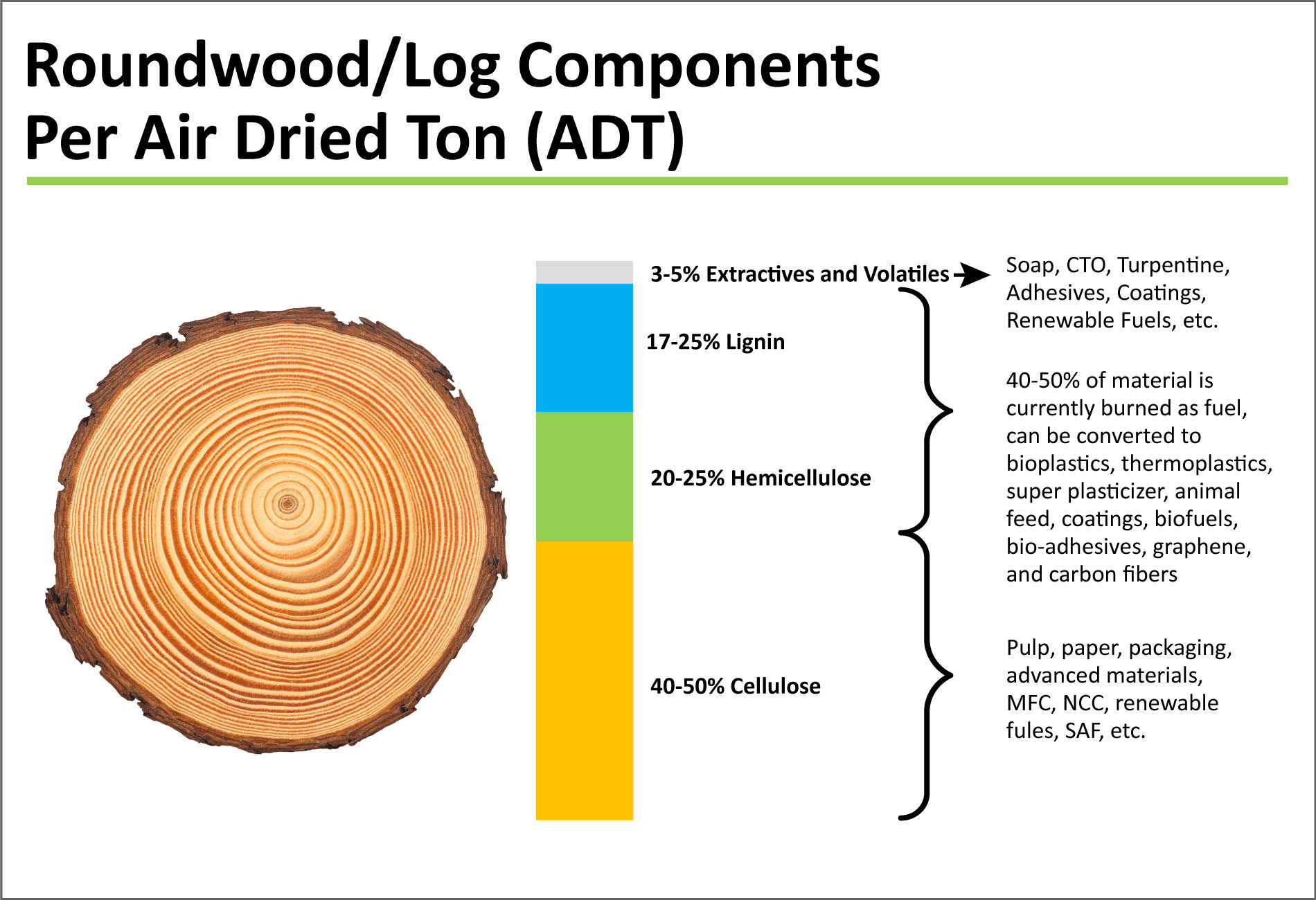

Pulp mills have a well-organized and sustainable wood supply, as they plant 2 to 3 trees for every tree they harvest, creating value for the tree farmers and others in the mill supply chain. The trees consist of cellulose (c6 sugar), hemi-cellulose (c5 sugar), lignin, tannins, and extractives. Chemically, trees are 48-50% carbon, 38-42% oxygen, 6-7% hydrogen, and several other elements, such as nitrogen and sulfur;in very small percentages. Thus, pulp mills and/or the wood can and do provide us with valuable sources of renewable materials, chemicals, and fuels.

White Liquor and Black Liquor

Kraft mills have become very efficient at using chemicals such as sodium hydroxide and sodium sulfide (“white liquor”) to separate the hemicellulose, lignin, and extractives from the cellulose fiber. During the cooking process, the white liquor becomes black liquor.

This black liquor contains the cooking chemicals as well as the other various fractions of the wood. The Recovery Boiler burns the black liquor to recover the chemicals and uses the other various fractions of the wood as an energy source for the mill. This made economic sense when the other fractions had little value. However, today’s demand for biobased products has changed their value proposition.

Over the last 50 years, many companies have developed products and end markets for these fractions. For example, the extractives in the black liquor and the volatiles from the digestor off gasses are used in household products we use every day. Extractives such as soap and crude tall oil fractions can be used in adhesives, asphalt, binders, coating, and lubricants, just to name a few. Demand for crude tall oil is continuing to remain strong, due to newly built fractionation capacity in Europe. As a result, the price of CTO has increased 10x in the last 7 years. Turpentine is used in perfumes, colognes, fragrances, juices, and toothpastes.

Lignin

Another valuable component in the black liquor is lignin, its main component. Lignin is one of the most abundant biobased polymers on the planet, and the industry is primarily burning it (over 99% or approximately 86 mm tons burned per year) to recover its energy content. Lignin-based products can replace numerous fossil-based products in applications such as plastics ($600B), batteries ($80B market), adhesives ($63B), feed ($70B), and dispersants ($7B). Lignin can also be used for water purification, to make graphene and carbon fiber, and many other highly valuable products.

Pulp

Pulp, or cellulose, is also a valuable feedstock for biobased chemicals. Mills typically sewer some portion of their pulp or take market downtime because they have excess pulp available. Cellulose can be refined into advanced materials.

NanoCrystalline cellulose is a high-performance material made from acidifying pulp mill cellulose. It is used in drilling fluids, paints and coatings, thin films, pharmaceutical, and cosmetics. For over 50 years, corn cellulose has been enzymatically hydrolyzed and the sugars then converted into fuel ethanol, producing 13 billion gallons annually of a high-octane super premium fuel in the USA alone. There are pathways from ethanol to renewable jet fuel (SAF) as well.

Other industries have pathways from cellulose to produce biosuccinic acid, biobutanol, and other high-value products. Customers in these markets are actively looking for such sustainable non-food feedstock sources to meet increasing market demand. In other words, although wood pulp will never be the least expensive form of sugar, there are numerous high value conversion opportunities for excess pulp as well.

Pulp mill or Refinery?

The answer is yes. Historically, the industry hasn’t experienced the need to innovate. It adopts change slowly. The slow and steady approach has been effective over the years. The capital has been focused on pulp and paper production, not growth. In some instances, companies limit capex investment into product change reconfigurations. However, in recent times, mills have been shut down or idled because of demand erosion.

In addition, pulp mills have outsourced technology, allowing third party companies to capture the value associated with change and innovation. The industry is well positioned for change. They have buying power, economies of scale, in house expertise, access to automation and other various production technologies, as well as a biomass-based supply chain. More importantly, they have valuable assets that are being idled. To thrive as a biorefinery, and to compete in packaging, advanced materials, biochemicals, and renewable energy markets, the industry will need to take back control of innovation.

They will also need to change the culture. Thus, for transformational change, industry leadership needs to set the strategy and focus on the long-term returns. Leverage proven technologies from other industries and collaborate with experts and technology providers. Communicate the growth opportunities to the investors. Industry leaders talk about sustainability, they talk about innovation, and they talk about a biomaterials future. It is now time to turn the intent into impact. For success, leaders will need to take risks, and for risks to be taken, they need to be properly understood. Implementation can be a bumpy road, but it is always more profitable to invest in the future than to invest in the past. I believe the industry can and will meet the challenge. The biggest risk is often doing nothing.

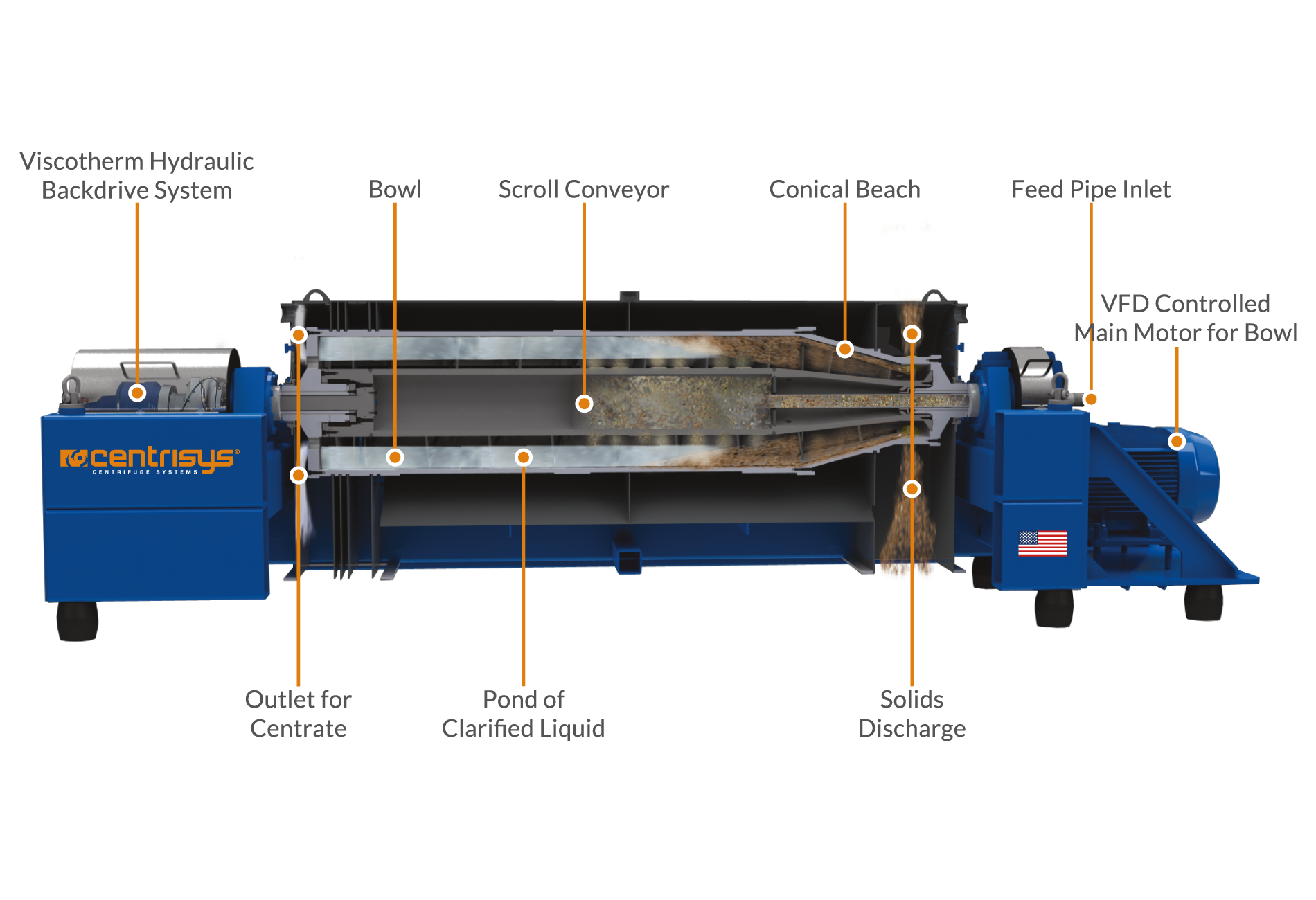

Contact Us to Learn More About Centrisys/CNP's Capabilities

We're dedicated to providing innovative solutions that enhance the efficiency and effectiveness of your processes. Whether you're looking to optimize performance, reduce operational costs, or explore our industry-leading technology, our team is here to help.